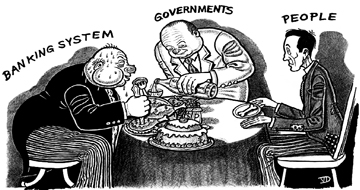

Early American Resistance to Hamilton’s Capitalist Policies

The concentration of economic power was built into the Constitution and enhanced by Hamilton who imposed different forms of British capitalism upon the former colonies that had just rebelled against those policies.